The Best Life Settlement Companies in 2024

In general, life insurance policies tend to get more expensive as the insured ages—even to the point of becoming impossible for many policy owners to afford. Instead of letting their policies lapse, encourage your older clients to consider a life insurance policy settlement as a much more practical and lucrative solution. Not only will a life settlement alleviate the costly burden that is their life insurance premiums, it can also provide them with a significant windfall—on average, they can expect to earn

Charting the Evolution of the Life Settlement Industry: A Look Ahead to 2024

The life settlement industry looks nothing like it did several decades ago, when it was unfamiliar to most and highly complex, depending on physical documentation and protracted communication via snail mail and phone calls. The result was that it often took a long time to execute a life settlement transaction. These days, though, the industry has experienced significant technological improvements—and roughly three decades of gaining a better understanding of the market—that make communicating about and carrying out life settlements significantly faster and

Hit a Goldmine with Orphaned Life Insurance and Settlement Policies

In recent years, the insurance sector has experienced a significant shift as Baby Boomer-aged insurance agents have begun to retire en masse, while the pandemic and economic strain have created downturns—leaving a sizable void in the insurance market. This situation begs the question: What will happen to their existing policies? The answer: Many life insurance policies—perhaps hundreds of thousands—are orphaned. What Is an Orphaned Life Insurance Policy? Also known as an “unassigned policy,” an orphaned life insurance policy is any active life

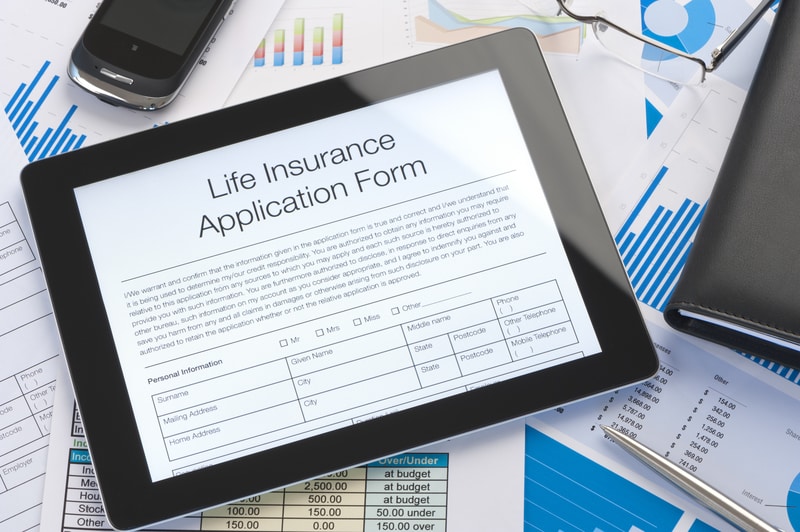

Maximizing Privacy in Policy Appraisal Before Engaging in a Life Settlement

Data privacy is an essential concern, especially in the financial sector—it’s never been more critical to protect the confidentiality of sensitive information. As they navigate the policy appraisal and life settlement process, life insurance agents should prioritize their professional responsibility to protect their client’s privacy. In this concise guide, we’ll outline essential steps and considerations for life insurance agents to safeguard their clients’ privacy during life settlement transactions without needing a broker. Brokers are best known for getting your client’s private and

How Financial Advisors Can Improve Senior Clients’ Digital Literacy

Living in an era defined by rapid technological advancement has revolutionized almost every aspect of our lives. Digital platforms provide us with a level of convenience and access that we couldn’t have imagined several decades ago. Despite all the benefits, however, the digital nature of modern life can be overwhelming for the oldest members of our society. After all, they didn’t grow up with these technologies, so it’s no wonder they often have trouble navigating them. Imagine being an older person contending

5 Risks Financial Challenges for Seniors to Consider Policy Appraisals and Life Settlements

Growing older can be a joyful, graceful period of life, especially when the fruits of one’s labor can finally be picked and savored. For many, the ultimate goal is the dream of riding off into the sunset of retirement and relaxation. However, that dream can quickly spiral out of control into a financial nightmare. The reason? Seniors are surrounded by financial risk caused by seismic shifts in the globalized economy, the rapid advancement of technology, the proliferation of bad actors, and unprecedented

Life Settlements Thrive Despite Recent Economic Challenges

With consumer concerns impacting both the amount and number of life settlements in 2021, the global economic environment has shifted to a heightened state of inflation and rising interest rates that could result in a recession. The report forecasts an average annual volume of new life settlements of $5.2 billion for 2022 – 2031, driven by the strong demand from investors for alternative assets and the development of a direct-to-consumer market. Such markets are becoming increasingly popular as consumers attempt to protect

Life Settlements: Way to Incorporate Estate and Tax Planning Strategies Into Planned Giving Programs

Life settlements are a form of planned giving that incorporates estate and tax planning strategies into the giving program. As such, these settlements provide organizations with valuable options that can help them receive donations from donors who may not otherwise contribute and improve their budget forecasting ability. Meanwhile, donors benefit from donating without depleting their reserves or losing income-producing assets, receiving fair market values for their donations instead of cash surrender values, having the satisfaction of seeing their donation put to use

Understanding the Tax Rules for Life Settlement Proceeds in 2023

Tax season is fast approaching, which is why it’s essential to understand how the proceeds of a life settlement are taxed. Not all life settlements are the same, as the amount of tax you will need to pay on a settlement can vary significantly for many reasons. Reaching out to a tax expert or an experienced accountant is always a good idea to better understand the tax implications of a life settlement. Here are a few things to consider for a life

Fixed Income Seniors Affected by Recession Hardest

An economic downtime can often have a much more significant impact on seniors due to a larger percentage of their wealth being invested in the stock market. Understanding how to hedge against the effects of a recession is essential in today’s uncertain financial landscape. The Great Recession in 2007 resulted in a decline in median wealth of around $72,000 for adults between 55-64 years of age. These figures will likely be much higher in the next economic downturn. Learning from mistakes in

Know your Fiduciary Responsibility and Life Settlements

Many Americans are taking a much closer look at their retirement plans due to the potential for a recession. Advisors should play an active role in offering valuable guidance during these uncertain times. Current retirees are especially vulnerable to a downturn, as many live on a fixed income that isn’t always enough due to recent price increases. While life settlements have been around for a long time, they remain an under-used source of funds for eligible seniors. A few common misconceptions contribute

Benefits of a Life Insurance Policy Valuation

Obtaining a life insurance policy appraisal can be beneficial for various reasons. A life insurance policy valuation is a crucial aspect of your overall financial plan, as it’s a good idea to perform frequent reviews to ensure the policy meets your expectations while also fulfilling your financial goals. You will need to evaluate several factors that impact your policy’s performance while also considering if a life settlement is suitable for your situation. When Should You Obtain a New Life Insurance Policy Appraisal?

Life Insurance Policy Valuation as a Client Service for Financial Professionals

Wealth managers play a crucial role in helping clients make financial decisions while also assisting in managing other vital assets. A wealth management advisor can even use life insurance as another way to help clients manage their finances. These financial advisors are trained to understand the actual value of a life insurance policy while determining if it makes sense for a client to consider a life settlement. What is the Purpose of Wealth Management? A wealth manager provides detailed financial advice while

What Is the Secondary Market for Life Insurance Policies?

The secondary market for life insurance policies makes it possible for people who need to quickly create liquidity to cover expenses to sell a life insurance policy for cash. Unfortunately, even those who sell life insurance may not be aware of its existence, and far too many financial advisors don’t realize its potential. Read on to get the facts about the secondary life insurance market. Primary vs. Secondary Market for Life Insurance Policies In the life insurance industry, the primary market is

COVID-19 Leading to Lower Life Expectancy and Higher Life Settlement Values

The number of Covid deaths significantly impacted the average life expectancy in the US in 2020. The life expectancy for Americans decreased by almost two years due to the Covid death toll. These numbers will have a significant effect on the life settlement market. Researchers haven’t seen such a drastic decline in life expectancy in the US in decades. Some experts even believe that US life expectancies will stagnate or even decline for the next few years. Other Past Events Impacting Life

Life Insurance During the COVID-19 Pandemic

Understanding how the rise in COVID cases impacts life insurance is essential. Many people have questions about the different types of life insurance coverage available. Getting answers to pandemic insurance coverage questions is crucial in giving you much-needed guidance, whether you need term life insurance or a whole life insurance policy. Reaching out to an agency can also help you better understand pandemic insurance coverage. Here is an overview of common questions about the relationship between coronavirus and insurance. Does Life Insurance

Remembering Betty White

One of the biggest challenges in the life settlement industry is the lack of consumer awareness. The Lifeline Program focused on overcoming this problem by creating a marketing campaign with Betty White over a decade ago. Betty White is known as the first lady of television. She helped significantly extend the awareness of life insurance settlement options by partnering with a company to create the video “I’m Still Hot,” which went viral on YouTube. Betty White’s birthday is January 17th, as she

Financial Advisors: Do Your Clients Have Hidden Assets?

Many American seniors are financially unprepared for retirement. Not being prepared for retirement can lead to stress and a wide range of problems. A financial advisor always plays a vital role in helping seniors prepare for life after work. Still, not all of these professionals are familiar with the value of a life settlement. Understanding the benefits of a life settlement is vital in helping seniors make financial decisions in their best interests. How a Life Settlement Benefits Seniors A life settlement

Can Insurance Companies Provide a Life Settlement Option?

For over two decades, many life insurance companies discouraged the use of life settlements. Some organizations even went so far as to forbid their agents from seeking a life settlement for their clients. However, some of the biggest life insurance companies are now offering some policy owners increased cash surrender values, which mimics the advantages of a life settlement. They attempt to encourage individuals to surrender their policies. These offers are a substitute for a life settlement. Some states believe that this

Are Life Insurance Companies Offering Cash Surrender?

Many people never thought that life insurance organizations would advertise policy surrenders rather than solely focus on acquiring new policies. For over twenty years, the majority of life insurance carriers opposed life settlement companies. Even some of these organizations denied their agents from seeking life settlement options for their customers. However, now some of the most well-known life insurance businesses are giving certain policyholders a better cash surrender value, which is similar to the advantages of life insurance settlements. These efforts are

Life Settlement Market and Economic Fallout from the Global Shutdown

Nearly 13 years ago, the life settlement market underwent a massive shift due to the 2008 financial crisis. Medical underwriters modified actuarial assumptions, and the financial crisis resulted in a convergence of events that massively impacted portfolios and caused investors to remain wary of the asset class. However, today’s stock market valuations are reaching near-record levels, and real bond yields are below zero. On the other hand, the asset class can deliver high single or even low double-digit annual returns, as life

Financial Planning for Elderly with Cognitive Decline

Helping elderly parents or older adults with financial planning is a reality for many people. Making plans in advance is essential in staying proactive while avoiding many problems. Unforeseen health issues can make it nearly impossible to pay the bills from their checking account if the son or daughter doesn’t have the authority to disburse money for these payments. Changing a will can also be challenging if a parent has dementia or cognitive decline. Looking at ways to avoid these problems by

Interest in Life Insurance Grows as Applications Increase

The number of people 71 and older buying universal life insurance continues to rise in the United States. According to an activity report from MIB Group, the individual life insurance application volume went up by 11.7% from April 2020 to April 2021. Life insurance application activity also experienced an increase of 18.5% in March 2021. MIB Group is an organization that works with insurers throughout the United States and Canada by providing information for life insurance underwriting. All of these life insurance

Term Life Insurance Conversion Option and Life Settlements

Many senior clients over 65 years of age aren’t aware that a term life insurance policy (if convertible) can be sold on the secondary market for a significant cash payment. Using this strategy can be an effective method for qualifying seniors that don’t need the coverage but are looking at ways to optimize the monetary value of the policy. Finance professionals need to discuss these options with each senior client if their term life insurance is getting close to expiration. Not making

Life Settlements as a Hedge Against Inflation

For agents and advisors who are under 50, the term “inflation” does not have a huge meaning beyond the textbook definition. Most folks from Generation X and younger did not experience the specter of inflation that haunted the 1970s – but their clients did. Many baby boomers, who are prime life settlement candidates, were coming of financial age in the ‘70s when prices and interest rates were out of control. High gas prices and mortgage interest rates get most of the historical

Older Seniors Increasing Factor in Life Insurance Applications

According to the latest stats from MIB Group Inc, consumers 71 and older continue to remain active in the individual life insurance policy application market in the United States. The activity report for new individual life applications highlights trends across all age groups. Understanding these various aging population trends is important in keeping up with the latest activity involving whole life insurance and universal life insurance. Overall, application value for individual life insurance slightly increased by 0.5% within the last year between

Millennials Depending on Boomer Parents for Financial Assistance

The skyrocketing prices of houses across the country are making it difficult for millennial first-time home buyers. Saving up enough money for home buying isn’t easy for most millennials, as many need financial assistance from their baby boomer parents. The high demand for new homes and the limited supply force many kids of the baby boomer generation to purchase homes much later in life. The millennial generation isn’t only becoming homeowners much later, but they often turn to others more often for

Life Settlement Transaction Safety

Many older Americans need extra cash and selling a life insurance policy through a life settlement is an excellent way to gain more money. However, some potential clients may have a few questions about life settlement risks. Understanding how to secure life settlements is essential before selling your life insurance policy. Fortunately, a life insurance settlement is one of the safest financial transactions available due to regulation. Approximately 90% of the citizens in the United States live in areas with various laws

Excess Deaths in 2020, 2021, 2022 and Life Insurance Actuarial Science

Life insurance companies globally paid out $5.5 billion in claims related to COVID-19 throughout the first nine months of 2021 while paying out $3.5 billion for the entire year of 2020. Many in the insurance industry expected lower payouts due to the availability of vaccines. However, the death increase was primarily due to the Delta variant, which is twice as transmissible as the original strain. Life insurance claims increased the most in the United States, South Africa, and India due to the

Financial Advisors – When Markets Are in Turmoil, New Evaluations are Vital

Dealing with stock market turmoil is often unsettling, especially if your clients plan for retirement. However, life insurance coverage can play a crucial role for anyone planning to retire. Periodically reviewing the life insurance policies of your clients can help you determine if everything is on track or if you need to adjust their policy. You will also need to review their policy due to various life events to ensure your clients will reach their long-term financial goals, even amid stock market

Do I Have to Pay Taxes on Life Insurance Settlement?

Trying to interpret various tax codes isn’t an easy task for most people. This is especially true with a life settlement tax. Several changes by the IRS even further complicates matters. Fortunately, the latest update is designed to simplify the entire process of working with life settlement companies. Life Settlement Tax Treatment Many people often ask, “Do you have to pay taxes on life insurance settlements?” The simple answer is yes, as a life settlement is taxable to the amount of profit.

Ways to Protect Seniors Against Identity Theft

Identity theft is a major issue for people of all ages. However, elderly people are especially at risk, as one in ten Americans who are 65 or older and live at home will become victims of elder fraud. Understanding how to prevent identity theft is essential in keeping your assets well protected at all times. Why Seniors Are More Likely to Experience Identity Theft Many seniors tend to have greater net worth and access to more capital compared to younger people. All

How a Policy Appraisal Protects Client Privacy

Privacy issues have been at the forefront of the life settlement industry since it began more than 25 years ago. The industry pre-dates the landmark Health Insurance Portability and Accountability Act of 1996 (HIPAA), and from its earliest days, we have had concerns about the private information of policy sellers being mishandled during a life settlement transaction. And unfortunately, despite regulations like HIPAA and best practices that are adopted by many companies, the process of determining the value of a life insurance

Everything You Need To Know About Life Settlements

Buying life insurance is a great way to keep your family protected in the event of a tragedy. However, you may want to sell your life insurance policy eventually. You may no longer need the policy, or your policy is reaching near its expiration date. A life settlement is also another way to supplement your retirement. Keeping all of these things in mind is important if you are thinking about selling your life insurance. What Is a Life Settlement? A life settlement

Even Captive Agents Can Take Advantage of Life Insurance Policy Appraisals

It’s no secret that insurance companies don’t like the life settlement industry. When a policy is purchased as a life settlement, by definition it will be held until the policyholder passes away, and the insurance company will have to pay the death benefit. We know that insurance companies make most of their money when policies lapse, and it’s fair to say that if every life insurance policy was purchased as a life settlement, then the entire industry would collapse. At the moment,

Why Agents Should Pre-Qualify Life Settlement Clients with Policy Appraisals

Becoming pre-qualified is all the rage. When we go to buy a car, we usually know whether or not we qualify to afford the payments. In the competitive world of residential real estate, if you’re not pre-qualified for a mortgage, you’re very likely to get shut out of bidding – particularly when the market starts to heat up like it is right now. Why wouldn’t you also want to pre-qualify your client’s insurance policy for a life insurance settlement? Agents and advisors

Long Term Value of Whole Life vs. Term Life Insurance

Purchasing life insurance is essential in giving financial security to your family once you pass away. You can choose between two different options, whether it’s a whole life or a term life insurance policy. Understanding the difference between whole life insurance and term life insurance is important before you purchase a policy. Whole Life Insurance The premiums of whole life insurance are often much more expensive than term life insurance for a couple of reasons. First, whole life insurance provides you coverage

Understanding the Cash Value of Life Insurance

Life never remains idle, but it’s constantly changing. The original need for buying life insurance coverage can easily change over time, as needing income replacement for young kids isn’t necessary after retirement. These policies may also no longer be affordable, as low-interest rates and the rapidly changing equity markets having significantly impacted older policies. One of the most simple ways to keep track of these changes is to conduct a policy review for you or your clients. A policy review can highlight

Life Insurance Settlement Options – How to Get Full Value

The Tax Cuts and Jobs Act (TCJA) contain two provisions impacting life settlements. The TCJA expanded the estate tax exemption while also changing how life settlements are taxed. Both of these changes created a renewed level interest and research for agents and consumers. Avoiding a lot of the industries known pitfalls like the releasing of private information and lengthy time wasted between applications, medical reviews and generating settlement offers, agents can now prequalify a senior clients life insurance policy to get the

Plunge in U.S. Life Expectancies Can Lead to Higher Life Settlement Policy Appraisals

Last spring at PolicyAppraisal.com, we wondered aloud about what effect the Covid-19 pandemic would have on life insurance policies. Sadly, we knew that many people were going to succumb to the coronavirus and that this would likely have an impact on life expectancies and how insurance companies view individual policyholders. At the time, we spoke to several agents, representing large institutions, and the typical response was that the wheels of change turn very slowly in the life insurance world and that actuarial

Old Term Policies Can Be “Found Money” for Seniors and their Advisors

Any financial adviser or insurance agent who’s reading this post should stop what they’re doing right now, and start developing a plan to reach out to every person that they have ever sold a term policy. Dig into your files and find all your term clients, and quite honestly, the older the policyholder the better. What you are looking for is “found money.” One of the best financial opportunities available to many seniors right now is what we call a term-to-perm-to-life-settlement transaction.

Appraise a Life Insurance Policy Before Letting It Lapse

Financial advisors spend a great deal of time studying market trends and learning about the best ways to manage money for their clients: understanding stock market history, teaching the magic of compounding, and explain the present value of money, among many others. I applaud them for their diligence in helping people save money for retirement and making sound, long-term plans. But when I speak to financial advisors and ask them to identify the biggest financial mistake a senior can make, almost every

2021, A Life Insurance Policy Appraisal Can Help Determine Taxation of Settlement Proceeds

Insurance agents and financial advisors fill many roles for their clients. Of course, they offer financial advice, but they also are asked about accounting and tax questions. Sometimes they also act as business coaches and even amateur psychologists. As we enter the new year, the economic situation for many will get tougher, and clients will have many questions for their advisors. It will be particularly challenging for folks on fixed incomes and small business owners. Things will probably get worse before they

Paperwork, Process, and Profits: Why Life Settlements Should Start with an Appraisal

Agents and advisors who are new to life settlements often ask about the difference between an application and a policy appraisal. Does one replace the other? Is an appraisal necessary? Which comes first? I would like to answer this by describing the three key differences between an application and an appraisal. And because everyone likes alliteration and cute wordplay, I have broken it down to three Ps: paperwork, process, and profits. P is for Paperwork Selling a life insurance policy traditionally includes

Plunge in U.S. Life Expectancies Can Lead to Higher Life Settlement Policy Appraisals

Last spring at PolicyAppraisal.com, we wondered aloud about what effect the Covid-19 pandemic would have on life insurance policies. Sadly, we knew that many people were going to succumb to the coronavirus and that this would likely have an impact on life expectancies and how insurance companies view individual policyholders. At the time, we spoke to several agents, representing large institutions, and the typical response was that the wheels of change turn very slowly in the life insurance world and that actuarial

Determining the Value of a Life Insurance Policy has Never Been Faster

More than 25 years ago when we first started working in what would become known as the life insurance settlement industry, it was a brave new world. Most insurance agents didn’t understand how the industry worked or how secondary market pricing was determined. Many agents and advisors didn’t know if life settlements were legal while big insurance companies tried to regulate us out of business. Well, it was and still is legal, but times have changed, particularly as it relates to how

Understand How COVID-19 Impacts Life Insurance

COVID-19 turned all of our lives upside down and caused varying levels of mental, emotional, and economic strain. Months after the initial lockdowns, people and businesses are still feeling the effects – and it’s having an impact on life insurance. Options if your client can’t afford premiums First, let’s talk about what to tell clients who can’t afford to pay their premiums. As the pandemic wears on, times are getting tough and many individuals are facing financial challenges. Clients might be thinking

Body Weight, Longevity and Policy Appraisals Go Pound for Pound

Understanding how long a client may live is a key factor in financial planning, and this should influence how much and what type of life insurance is recommended by agents. Most individuals may think about their longevity when they first purchase insurance, and then they forget about this aspect of their plan and leave their life insurance on autopilot. They see monthly payments being debited from their account, knowing that they are protecting their loved ones, family members or other beneficiaries. We

Top 5 Reasons to Recommend a Life Insurance Policy Appraisal

5 Top Reasons for Life Policy Appraisals that Take Advantage of Inappropriate Coverage. For insurance agents who haven’t yet counseled their clients about life insurance policy appraisals, here are the five top reasons to recommend an appraisal today. If a client is planning to let a policy lapse. If a client is considering letting a policy lapse, it turns into a huge lose-lose scenario for the agent. First, the agent will stop earning residual income on the policy, and second, there’s a huge

New Technology Enables Agents to Text Questions to PolicyAppraisals.com

When we first started working with the life insurance industry, it was utterly dominated by paper. Getting any information from an insurance company took seemingly forever, often requiring multiple conversations and repeated attempts to get information. The same was true when securing medical records and trying to get applications completed. Some months it seemed like our FedEx and postage bills were higher than our rent. Thankfully, technology has changed a lot of the issues which slowed down the insurance industry in the

Policy Appraisals Can Help Keep a Strong Agent and Client Relationship

We all know that residuals are the lifeblood of the life insurance industry. Agents work incredibly hard to sign-on clients, knowing that if they play their cards right and build a nice book of business over time, residuals will help them grow their wealth. However, when times are tough, like now, clients are looking at their bills and wondering if they should continue to pay their life insurance premiums. Maybe they have lost income, or their spouse or a family member has

Life Insurance Policy Appraisals Grow In Value Due To Pandemic

The coronavirus pandemic has sent shockwaves through economic markets across the globe. Many retirement accounts have taken significant hits, and it remains unclear what the impact might be on other key assets like real estate holdings. Even the employment prospects have changed for some seniors and others who thought they were in stable industries. Quite frankly many individuals who thought they might be retiring soon have to perform a complete re-evaluation of their retirement plans. In order for financial advisors to get

Provide Safety, Security and Flexibility in Troubling Times

While average financial advisors have all but given up on succeeding in 2020, astute advisors like you know that the sky is the limit when it comes to gathering Assets Under Management (AUM) during the remainder of the year. While the COVID-19 pandemic has negatively impacted America’s financial markets as it has upset many of America’s businesses, it has also provided us with tremendous opportunity. Ironically, John F. Kennedy once said “When written in Chinese, the word ‘crisis’ is composed of two

Maturing Term Policies can Equal Huge Profits

Even in times of financial stability, aging clients with maturing term policies have a huge decision to make. Do I convert my term policy to a permanent policy at staggering premium rates? What happens in times like these? How much more difficult is this decision after businesses have been closed for nearly two months? How much more difficult is this decision when investment portfolios have taken 10%, 20% or 30% hits? What if there were an alternative solution? What if that alternative

American Life Insurers Mortality Tables are Expected to Shift due to Coronavirus

U.S. life insurers are deciding not to gamble on older Americans during the coronavirus (COVID-19) crisis by temporarily suspending applications from certain age groups or imposing tougher requirements. Insuring older Americans can be a big risk for U.S. life insurers under the best of circumstances, but it brings in hefty premiums. But the risk involved with insuring older Americans during a world pandemic is expected to bring changes to the industry. The biggest shift may occur first on the mortality tables of

Life Insurance Applications Surge during Pandemic against LIMRA Survey

LIMRA, the Life Insurance Marketing and Research Association conducted a survey of American and Canadian life insurers to assess the effect of the global pandemic on business practices. In all, 47 U.S. carriers were surveyed to see if any changes were being made as a result of state and federal social distancing guidelines and 12 Canadian carriers were surveyed to see if parliamentary and provincial guidelines necessitated any changes. The survey found that there were no significant changes in the number of

Experience Matters

Since 1989 we’ve completed thousands of policy appraisals and provided policyholders with access to hundreds of millions of dollars in cash. We’ve also paid out the most aggressive referrals fees in the business to life insurance agents and financial advisors. Every member of our management team has in excess of 30 years of experience in policy appraisals. We have routinely provided expert witness testimony in both state and federal courts for decades. We are called to testify as expert witnesses because we

Many Seniors Need to Monetize their Most Stable Asset

One of the most widely anticipated provisions of the Coronavirus Aid, Relief, and Economic Security (CARES) Act is the one-time stimulus checks promised to Americans in the coming weeks. But many isolated seniors have been left understandably confused and nervous about whether and how they will receive money, or their retirements will be affected. Financial advisors have never been more important to their clients than they are right now. With America caught in the throes of a worldwide pandemic, most everyone has